Estimating the market value of commercial properties, whether it’s a hotel or another type of real estate, It can be perplexing for new investors and property owners.

Below, I outline three common approaches I employ to determine the market value of commercial properties.

First, I use the market comparison approach, where the property’s value is inferred based on the sale price of a similar property. Next, I consider the cost approach, which assesses the value based on the cost to construct a replacement, minus depreciation.

Lastly, I utilize the income approach, which focuses on the property’s income-generating potential.

The market comparison approach is an effective method when multiple similar properties are available for comparison. This approach begins with researching the hotel transaction market to identify recently sold properties that are comparable in terms of price, room count, amenities, condition, and sale conditions. Next, it involves filtering out properties that do not accurately reflect the subject property’s value due to factors like non-arm’s length transactions or partial interest sales. The selected comparables are then assessed by comparing their physical characteristics, location, sale timing, condition, and financing against those of the subject property. Adjustments are made to the selling prices of these comparables to account for any differences, ensuring they reflect the market’s reaction to these variations. Ultimately, this analysis leads to a final estimated value for the subject property.

The cost approach is particularly useful for evaluating properties built to specific chain standards and newer properties. This method begins by estimating the replacement cost, which involves determining the current cost to either reproduce or replace the structure and other improvements, excluding land value. Reproduction means creating an exact replica, while replacement refers to constructing a building with similar functionality using modern materials and techniques, with replacement being more common, especially for older buildings. Next, depreciation is assessed using methods like the straight-line method, based on the property’s age relative to its expected useful life, or the breakdown method, which considers physical deterioration, functional obsolescence, and economic obsolescence. The total depreciation is then subtracted from the estimated replacement cost. Following this, the land value is estimated as if it were vacant, often using the market comparison approach. Finally, the total value is calculated by adding the land value to the depreciated replacement cost, resulting in the property’s total value estimate using the cost approach.

Income Approach

The income approach values a hotel and other commercial property based on the present value of its anticipated future cash flows. I use capitalization rate approach.

First, I will discuss the model, followed by an example. In this approach, the property’s value is determined by dividing the stabilized net income by the capitalization rate.

Value = Stabilized Net Operating Income (CFFFO)/ Capitalization Rate

The stabilized net operating income (NOI) is derived from a projection of revenues and expenses, considering long-term equilibrium conditions for the property. This figure is not simply the most recent NOI; instead, it is the result of a thorough evaluation, after assessment of the revenues and expenses expected under competent management operating the hotel at long-term equilibrium. I use the following methord to estimate capitalization rate.

Capitalization Rate Calculation

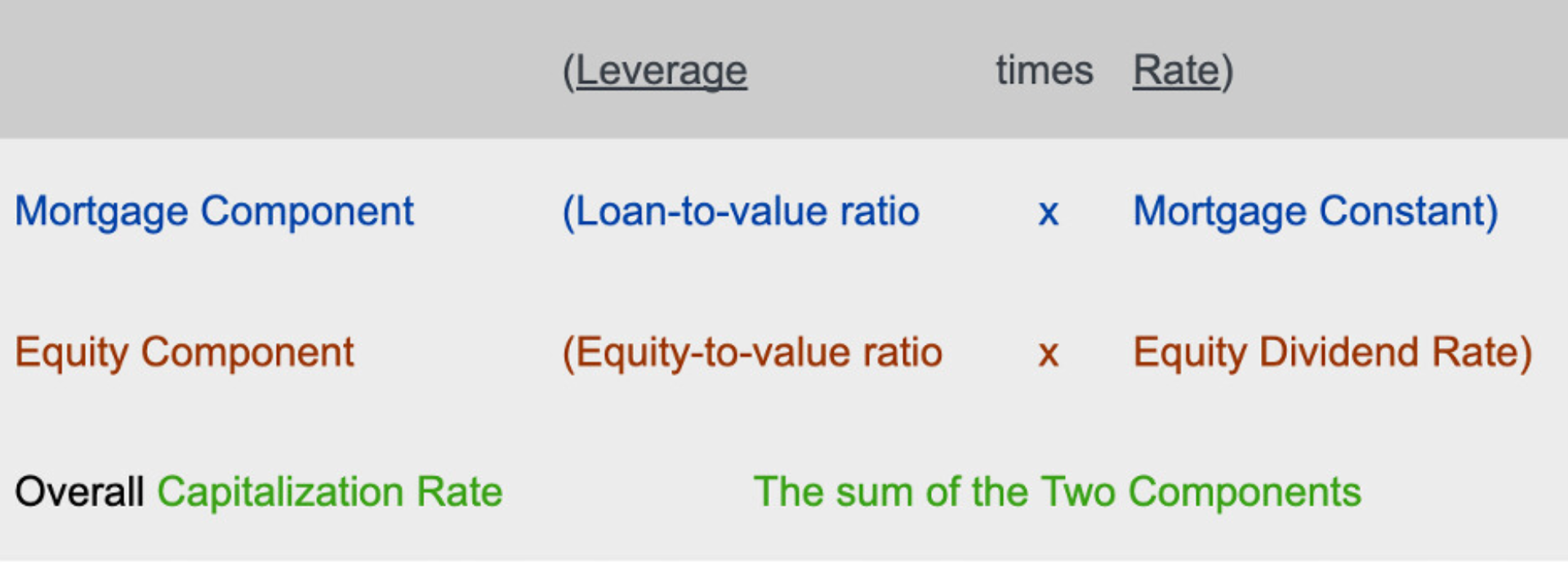

The capitalization rate is determined by calculating a weighted average of the costs associated with mortgage financing and equity financing. The weights are based on the typical proportions of each type of capital used in hotel investments. Each component is estimated individually, and then they are combined to form the overall capitalization rate.

First, multiply the loan-to-value (LTV) ratio by the mortgage constant. Next, multiply the equity-to-value (ETV) ratio by the equity dividend rate. Finally, sum these two figures to estimate the capitalization rate.

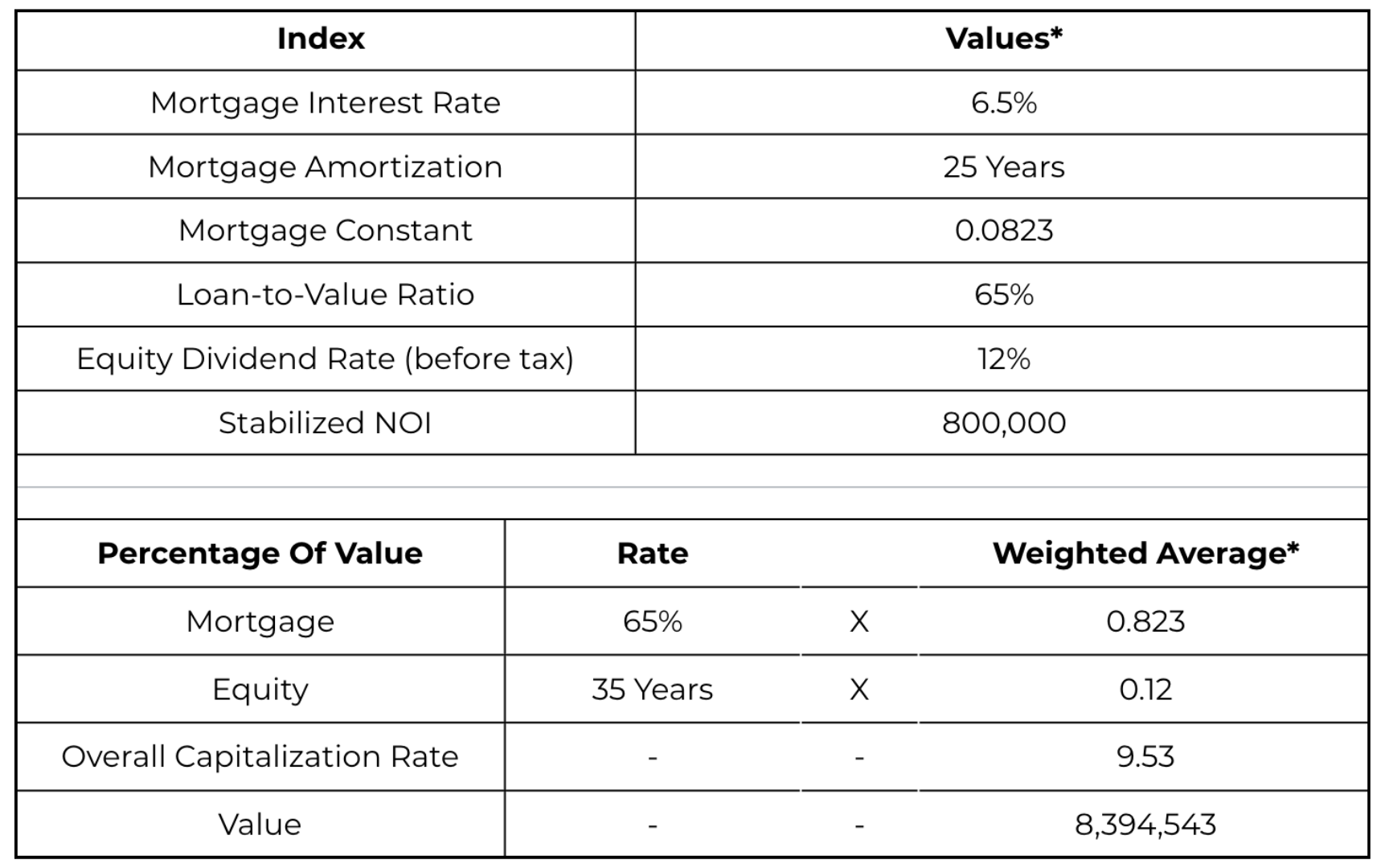

To illustrate, please see following example of a Hypothetical Hotel in Alberta.

The model provides a very precise estimate, down to the dollar, with the capitalized value of the property calculated to be approximately $8.3 million.

*Note: These rates are hypothetical and provided for better understanding.

If the explanation above seems overwhelming, I’ve created a sheet to help you estimate the Cap Rate and calculate the property value using the NOI and Cap Rate. To get access to the calculator, kindly click on the button given below –

One of the main strengths of the capitalization rate approach is its analytical simplicity. It doesn’t require a multi-period forecast and depends on readily available capital markets data, which is a significant advantage. Additionally, the necessary property and market information is usually well-supported, though finding reliable data for the equity dividend rate can be challenging. This approach is particularly useful for stable properties in stable markets.

On the downside, the model does not account for changes in the market or the property itself. If future cash flows deviate from past patterns, estimating a stabilized year can be quite difficult. Furthermore, it is a dividend-based model rather than yield-driven, which may not align perfectly with investors who focus on yields. Lastly, the model only considers a single year of cash flows, ignoring cash flows over the holding period and the property’s sale at the end.

In addition, the choice of cap rates is a subjective matter, as investors need to account for budgeting capital expenditures related to income improvement, the expenses of asset stabilization, and the adjustment of their anticipated returns over time.

For guidance in buying and selling hotels and industrial properties in Alberta, along with comprehensive market analysis and property consultation, reach out to me.

Contact me at 306-221-1322 or explore more at gurveen.bindra@royallepage.ca

I’m committed to assisting you to simplify the process of buying hospitality and Industrial assets in Alberta.

As a Commercial Real Estate Associate at Royal LePage Commercial, this blog is where I share insights and advice on navigating the world of commercial real estate. My goal is to provide you with the expertise and support you need, whether you’re buying, selling, or investing in hotel or industrial properties.