This report offers an in-depth analysis of the real estate market dynamics in Red Deer and Fox Creek, focusing on key metrics such as market sale price per room, Average Daily Rate (ADR), and occupancy rates. Through a comparative lens, the report highlights the unique characteristics and investment opportunities in both markets. Red Deer emerges as a stable, growth-oriented market with affordability as its hallmark, while Fox Creek presents a premium yet variable landscape, offering the potential for high returns. Whether you’re an investor seeking steady long-term growth or aiming for higher stakes, this report provides essential insights to help guide your investment decisions in these distinct Alberta markets.

Red Deer Market Trends; Stability with Growth Potential:

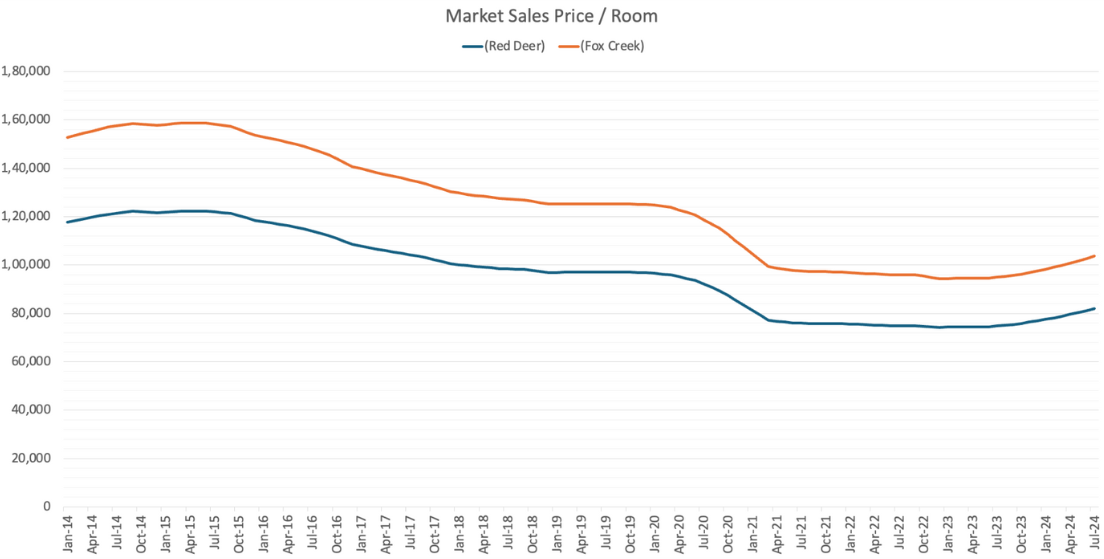

Affordable Market: The minimum value of $74,256 in December 2022 suggests that Red Deer offers more affordable options, which could be attractive to buyers looking for lower entry points into the market.

Fox Creek Market Dynamics; Premium Market with High Variability:

Potential for High Returns: With the maximum value reaching up to $158,753 in June 2015, Fox Creek represents a market where high returns are possible. However, the variability also implies the need for careful consideration to maximize returns.

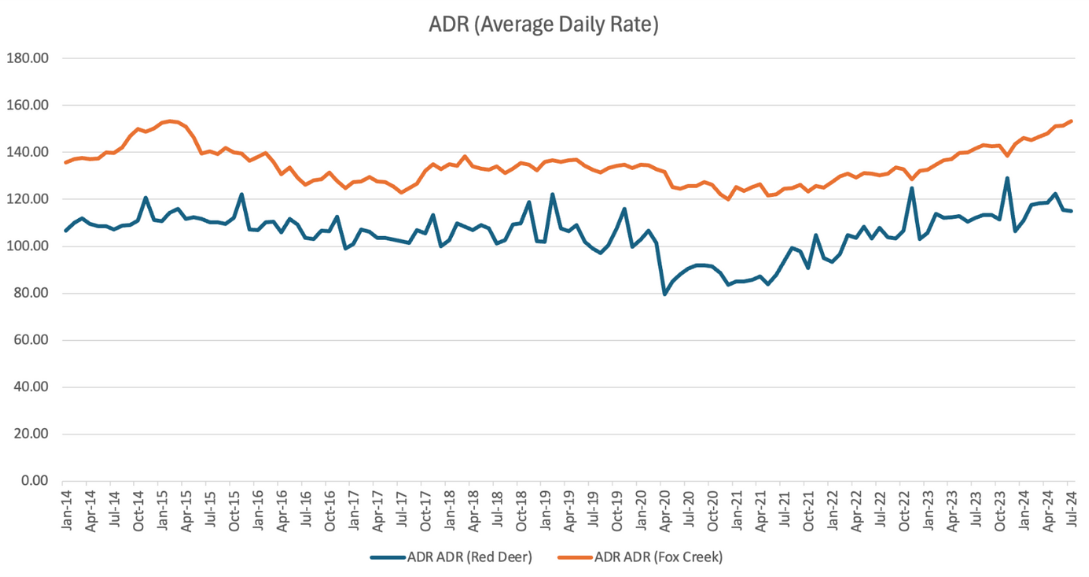

Red Deer:

Fox Creek:

Red Deer:

Fox Creek:

Comparative Insights:

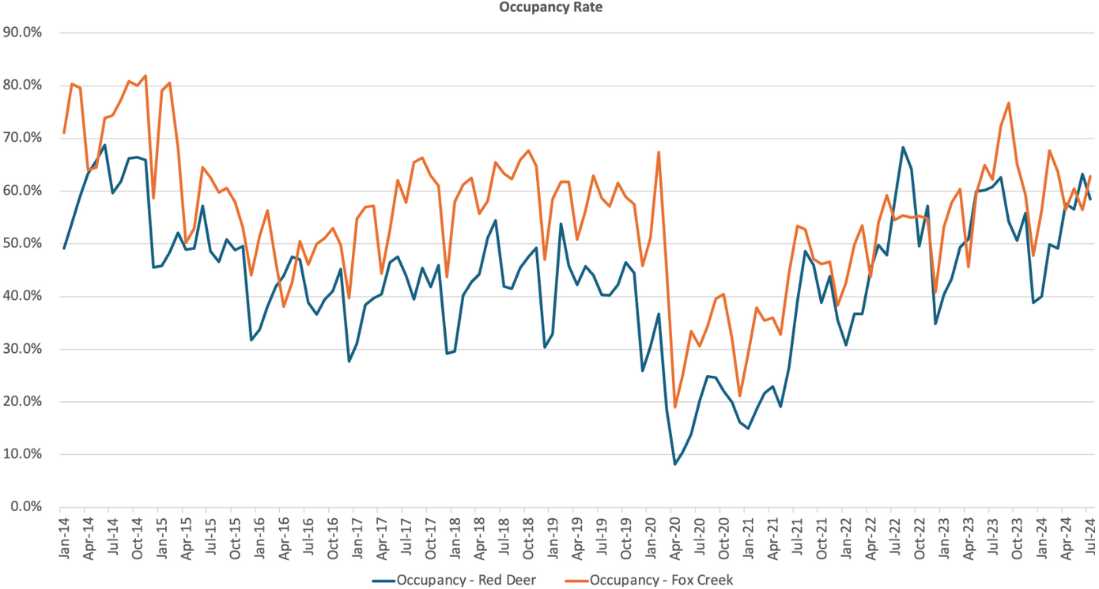

Red Deer

Fox Creek:

Red Deer:

Fox Creek:

Comparative Insights:

In summary, the real estate markets of Red Deer and Fox Creek present distinct opportunities for investors with varying risk appetites and investment strategies. Red Deer, with its steady growth and affordability, is an attractive option for those seeking predictable returns and a stable entry point. Conversely, Fox Creek’s premium market offers the potential for higher returns, albeit with greater variability, making it suitable for investors willing to navigate its dynamic landscape. By understanding the unique characteristics of each market, investors can make informed decisions, whether they choose to focus on stability or pursue higher returns. Ultimately, the choice between Red Deer and Fox Creek depends on individual investment goals and risk tolerance, with both markets offering valuable opportunities in Alberta’s real estate sector.

Date Source:- Costar

As a Commercial Real Estate Associate at Royal LePage Commercial, this blog is where I share insights and advice on navigating the world of commercial real estate. My goal is to provide you with the expertise and support you need, whether you’re buying, selling, or investing in hotel or industrial properties.