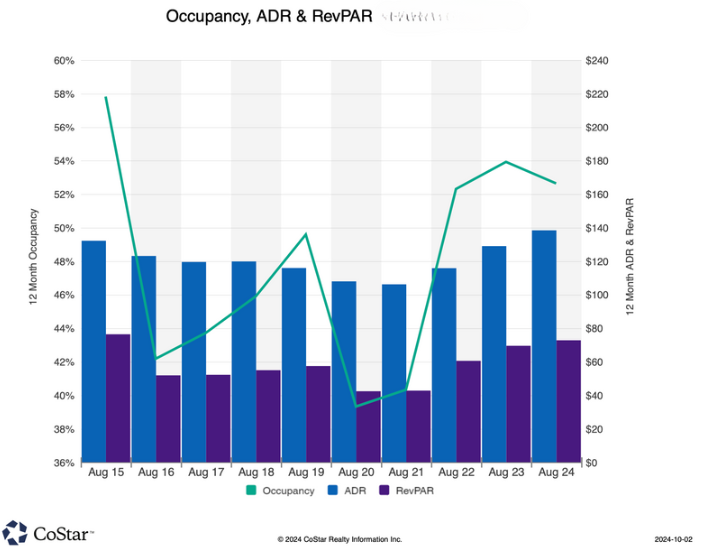

Hinton, Alberta, is a critical hospitality submarket within the larger Alberta North Area, with a total of 1,277 rooms distributed across various economy midscale and upper midscale properties. The market is influenced by nearby attractions such as Jasper National Park and offers a combination of leisure and business accommodations. The market is showing resilience and gradual improvement, with key performance metrics such as occupancy, ADR (Average Daily Rate), and RevPAR (Revenue per Available Room) playing vital roles in gauging its performance.

Alberta Market Size Overview:

Source: Costar

Alberta North Market Overview:

Source: Costar

The Hinton hospitality market faces moderate challenges with slightly lower occupancy rates and ADR compared to the broader Alberta North market. However, the market remains stable with room for growth.

Midscale and upper midscale properties form the core of Hinton’s hospitality offering. These properties cater to budget-conscious travelers, corporate guests, and leisure tourists.

Source:- Costar

The upper midscale properties outperform the midscale segment in terms of both occupancy and ADR. This suggests that guests are willing to pay more for added comfort and brand assurance in the upper midscale category, leading to higher RevPAR for these properties.

Several infrastructure projects are underway in Hinton, which are expected to positively impact the local economy and, consequently, the hospitality market:

Source:- Hinton.ca and zillow.com

5) Infrastructure Impact on Hospitality:

The ongoing infrastructure improvements, such as the water treatment plant and the Maxwell Lake pedestrian bridge, are set to have long-term positive effects on the Hinton hospitality market. These projects will improve the quality of life for residents and visitors, making Hinton a more attractive destination. Additionally, the development of PAR999 Holdings’ hospitality resort and conference center is expected to increase the demand for accommodations, particularly in the upper midscale segment.

6) Key Takeaways:

Occupancy Trend:

ADR (Average Daily Rate) Trend:

RevPAR (Revenue per Available Room) Trend:

Key Takeaways:

The Hinton hospitality market has seen significant change over the past decade, from economic challenges to a strong post-pandemic recovery. With rising occupancy rates, increasing ADR, and new infrastructure projects, the market is well-positioned for growth. The upper midscale segment, in particular, offers strong potential for higher revenue and demand.

Now is the time to explore opportunities in Hinton’s hospitality sector. By focusing on guest experience, eco-tourism, and aligning with new developments, businesses can take advantage of this growing market.

Interested in learning more about the Hinton hospitality market? Contact me today for insights, investment advice, and strategies to help you succeed in this promising market. I am here to help you take the next step.

Email: gurveen.bindra@royallepage.ca

Cell: (306) 221-1322

Let me guide you towards informed decisions and successful investments.

As a Commercial Real Estate Associate at Royal LePage Commercial, this blog is where I share insights and advice on navigating the world of commercial real estate. My goal is to provide you with the expertise and support you need, whether you’re buying, selling, or investing in hotel or industrial properties.